That BTO flat that you and your spouse bought, is about to reach its long awaited five year minimum occupancy period. That means you have the option of selling it. What should you know before you make that decision to move? You’ve probably seen flyers from many agents telling you to cash out and heard the term asset progression.

What is asset progression, what does that really mean?

What is asset progression?

Asset progression is upgrading your current property (asset) to one of a higher economic value. It is a long term financial plan aimed increasing the end value of what your property would be worth. For most, your property is likely going to be your biggest asset. A property can also be more than a home, with a good roadmap, it could be your retirement nest egg. By progressing from one property to the next and making a profit each time you could end up with more capital than when you first started. As compared to someone who owned only one property in their lifetime, you are more likely to make significant capital gains through asset progression. If you currently own a HDB, you have good potential for asset progression. Lets discuss below.

First things first. How much is my HDB flat going to be worth upon MOP?

First thing you should figure out is how much your flat is going to be worth on the market today. You probably bought the flat under the BTO or Sale of balance flats scheme at a highly subsidized price. Your flat could commonly appreciate anywhere from 30-50% in value or possibly even more. The possible resale value of your newly MOP flat would depend on factors like its floor; renovation; condition; facing and orientation.

*If you need a free valuation of your property, simply fill up this form.

Next, you need to be aware of when your actual MOP ends. You can easily check on the HDB hub website, where all the information can be accessed via your Singpass.

Lastly, you will need to work out if would make a profit if you sell your flat. To find out your nett profit after selling your house, you would need to know the following:

- Outstanding mortgage amount

- CPF monies used and accrued interests to be returned to your CPF account

- Other Outstanding Payments (Service & Conservancy Charges (S&CC) arrears, Property Tax etc).

After deducting your costs from your estimated sale price, if you have made a paper gain in value, congrats!

You can now decide if you would like to cash in on that profit by selling your flat. As an example, a 5 room flat in Sengkang that was purchased for $350,000 in 2013, would likely resell for $550,000 on average. In order to actualize this $200,000 profit, you would need to sell your flat. Now that you have made some money from your HDB flat, lets have a look at what are your options.

*If you require assistance to do your financial calculations, simply contact us.

What should I buy as my next house, if I sell my HDB flat?

Option 1. Asset progression with a New Condo

When people talk about asset progression, the most common example of this is upgrading to a newly launched condominium. Buying a new condo allows you an opportunity to buy a home that has the potential for good capital appreciation.

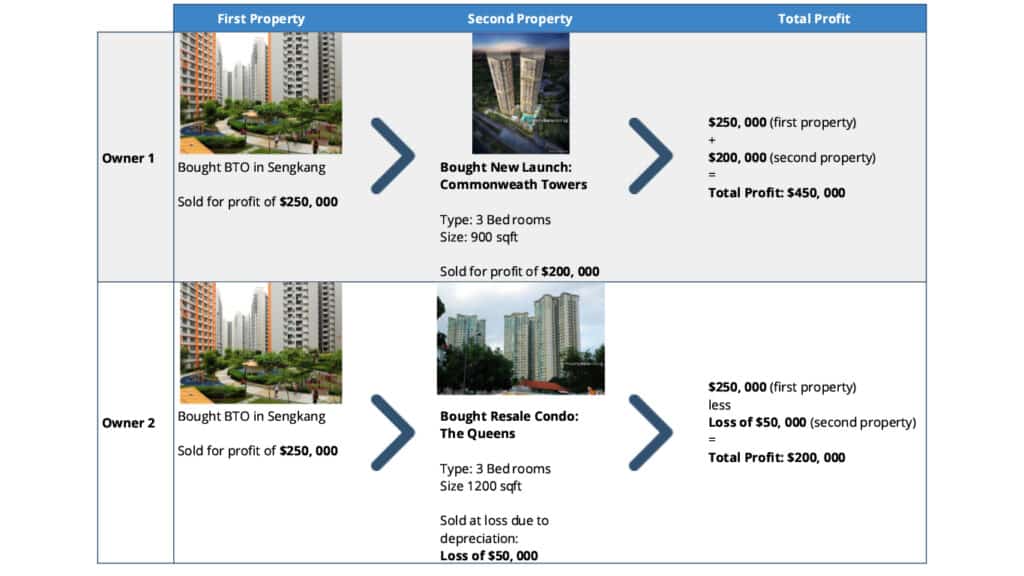

Lets look at an example, if you sold your HDB flat (from the previous example) and bought a unit at Commonweath Towers in 2017. Averagely a 904 sqft unit at Commonwealth Towers bought in 2017 and then sold in 2020 made a profit of roughly $250,000. This means that you would have made a $200,000 profit from your HDB over the eight years you owned it, and then a further $250,000 profit on the next condo. Total estimated profits of $450,000 over a period of 11-12 years.

It’s an attractive proposition for many people but let’s discuss some of the trade offs as well. By selling your HDB before your new condo has been constructed means you will have to find an alternate home in the meantime. Construction usually takes about two to three years. For the lucky few, they can move into the spare bedrooms at their in-laws place. Others might have to consider renting a place before you can move into the new condo. This means you might incur rental charges and will be faced with the hassle of moving a few times. Some families might be hesitant to move once they’ve settled into a house. So this process of asset progression works best for families who have more flexibility in their living arrangements

It will all be worth it once you realize that your second property has made you a healthy profit. You can then choose to sell your condo away, actualized your gains and look for your next property. At this point you can consider moving into something that has more quality-of-life aspects. For example, a more spacious unit, a home with a yard for the family dog or one with the view you always dreamed of. Or, of course, reinvest in another property with capital upside.

Option 2. Resale HDB or a resale condo

Yes this is definitely an option. If your family has other priorities other than profit, you can consider resale properties.

One reason people like resale condos, is that older condos tend to be built bigger. If you look at condos that were built in the 80s or 90s, a typical three bedroom unit might be about 1200 sqft, while more modern ones are about 900 sqft. So if a larger space is a priority, an older condo might be a better fit.

Also, although new condos have better potential for capital upside, you never know where the next launch is going to be. So that gives you less control over where you want to live. A very common example of this, are families that buy a resale condo, to be able to be within 1km from a certain school, to help them secure a place for their kids in their dream primary school. Or maybe there is a certain neighborhood, that you just love, that doesn’t have a new launch condo this year. In this sense, resale condos give you more control over where you want to live.

Another reason people might choose to go with a resale condo, is that they can move in almost immediately. Resale condos give you more control over WHEN you get to actually move in. Without having to wait for your new place to be constructed, you will be able to enjoy your new property much sooner.

Some things to note about resale properties

It is vitally important to pick the right unit, as older units tend to have issues relating to wear and tear. They could require substantial renovation and maintenance. You might also prefer to live in a property that is spanking new with updated facilities. Older developments might have outdated facilities that you might never utilize. Lastly, because they are older, they lack the same ability to generate capital upside as compared to newer projects.

But you might have some quality of life aspects that are more important to you. So it’s really about finding that perfect home that fits your current goals for you and your family at each stage of your life.

Option 3. Another BTO flat from HDB

You could also explore the idea of getting a second BTO to try and make the same profit again, but we wouldn’t recommend it. And here’s why.

Firstly, getting a second BTO, means you’re going to have to pay a resale levy, as this would be your second subsidized house from HDB. The amount you have to pay is shown below in this handy table, but also note that resale levy has to be in cash, not CPF!

The resale levy would erode away your potential profits. Also, a BTO would require you to wait for it to finish construction, and then you would need to wait out the five year MOP again. This means that it could typically take 8-9 years for you to make that profit. New condos are a better vehicle for potential profit, as they do not have the same restrictions on holding period. In the time you take to sell your second BTO, you could have bought and sold private properties 2 or 3 times.

The amount of time it takes for you to be able to actualize profit is important. Because you are using your property as a vehicle to grow your wealth, is easier the younger you are, as you are more easily able to get favorable loan terms. Securing a loan is easier in your 30s compared to when you are in your 50s. It also gives you more chances to time the market and to ride out its cycles.

If you are interested to learn more about asset progression and to craft a plan for your needs, contact us at Insight Homes for a free consultation. Our experienced realtors can help you map out a plan that is inline with your families needs, financial abilities and goals.